Recommendation 5

Effective operation of local alternative infrastructure business models requires greater fiscal decentralisation,complemented by a stronger and statutory devolved role for cities and localities in the planning, development and delivery of infrastructure

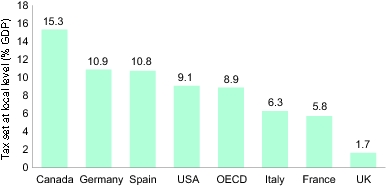

The UK is a centralised political economy, with a highly concentrated system of taxation and expenditure, in an international context (Figure 2). The UK’s ‘tax to GDP ratio’ is 35%, according to the Organisation for Economic Cooperation and Development, and local government is responsible for raising 1.7% of tax revenue as a percentage of national GDP. In contrast to many other countries, infrastructure decision-making in UK cities and localities is dominated by centralised mechanisms, which can hinder local innovation and experimentation as the funding, financing and revenue raising powers are inappropriate for delivering local infrastructure and growth. London, for example, relies more heavily on inter-governmental transfers than locallyraised revenues, compared to global competitor cities, such as New York, Paris and Tokyo.[30*] In a time of austerity, local government budgets have been reduced significantly. Whilst the UK Government has introduced some reforms to local authority finance in England, iBUILD research reveals that the ability of localities to reap and reinvest (in infrastructure) more of the proceeds of growth remains constrained.[31*] The issue has been given fresh impetus in wake of the Scottish independence referendum. In a fiscally-constrained environment, iBUILD analysis highlights the benefits to the UK economy, in terms of recovery, renewal and rebalancing, of central government adopting a more appropriate, planned and a flexible approach to fiscal decentralisation, which would enable local areas to retain more locally generated revenue.[32*] This must be accompanied by broader devolution of infrastructure planning, regulation and delivery. In return, cities and local areas should play a more prominent role within national infrastructure planning than they do currently.

Figure 2. Tax set by all sub-national governments in selected OECD Members States as a % of 2011 National GDP (OECD data is for 2010)

Revolving investment funds for local infrastructure

Revolving funds are accounts that remain available to finance continuing operations without any fiscal year limitation on the premise of loan or equity investment generating returns or repayment that are invested in new projects. They can be applied to a variety of different forms of infrastructure with varying structures, scales, business models and governance |